ri tax rate on unemployment benefits

UI provides temporary income support to workers who have lost their jobs through no fault of their own and have earned enough wages within a specific base period to qualify. State Taxes on Unemployment Benefits.

Speeding The Recovery Of Unemployment Insurance

UNEMPLOYMENT TDI TCI INSURANCE INSURANCE TAXABLE WAGE BASE 24600 74000 For Employers at the highest tax rate 26100 TAX SCHEDULES Schedule H.

. The Department of Labor and Training DLT today announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022. The Rhode Island UI tax rate schedule known as the experience rate table Schedules A I under Rhode Island General Laws 28438 is determined based on the amount. This is an increase of 7500 101 from the 2021 taxable wage base of 74000.

2022 New Employer Rate. This will also be mailed to claimants. Because of the high.

UI tax rate schedule that applies to all employers could change for 2021. For information on reporting UI fraud. UI tax rates are calculated using a statutory formula based on the balance of the states employment security fund.

However as of January 2022 the unemployment rate sat at 4 and the number of unemployed individuals was 65 million. Unemployment Insurance UI is a federalstate insurance program financed by employers through payroll taxes. For most Rhode Island employers the taxable wage base for calculating the Rhode Island unemployment insurance UI tax will be 23600 for 2019 compared with 23000 for 2018 an increase of 600 or 261 percent.

Rhode Island is to use a Nov. For homeowners in Rhode Island the median property tax rate is 1533 per 100000 of. The tax breakdown can be found on the Rhode Island Department of Revenue website.

30 computation date Moving the computation date is to avoid assessing higher unemployment tax rates for 2022 Under the order 21-102 the computation date is to be moved to Nov. Your weekly benefit rate remains the same throughout your benefit year. Taxable wage base generally means the amount of an employees wages to which the tax rate applies.

The rates range from 375 to 599. Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600. By law the UI taxable wage base represents 465 of the average annual wage in Rhode Island.

26100 for those employers that have an experience rate of 959 or higher Employers will be notified in late December of their individual tax rate. As a result of this action Schedule H with rates ranging from 12 percent to 98 percent will remain in effect throughout calendar year 2022. Unemployment benefits are.

One Capitol Hill Providence RI 02908. WPRI Any Rhode Islanders who received unemployment benefits during 2020 will have to pay state taxes on them. For example that means if your weekly benefit amount is 100 you can earn up to 149 working part time.

The form will show the amount of unemployment compensation you received during 2021 and any federal. McKees recently issued Executive Order 21-102 which delays the deadline of September 30 2021 for computing the 2022 state unemployment insurance SUI tax rates. Federal income tax is withheld from unemployment benefits at a.

CRANSTON Rhode Island businesses wont see an increase in their unemployment insurance tax rate for 2022 even though the trust fund that keeps benefits flowing was heavily used this year according to state labor officials. Normally unemployment benefits are subject to both federal and Rhode Island personal income tax. Established employers are subject to a lower or higher rate than new employers depending on an experience rating.

You can now earn up to 150 of your weekly benefit rate and still receive a partial benefit. This number is significantly lower than the same time in 2021 when the unemployment rate was 63 and the number of unemployed individuals was 101 million. The Department of Labor and Training DLT on Monday announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022.

Department of Labor and Training has announced that tax rates will remain in the range of 12. 1 Unemployment Insurance 2 Job Development Fund and 3 Temporary Disability Tax. Contributions collected from Rhode Island employers under this tax are used exclusively to pay benefits to unemployed workers.

The rate for new employers which is. However the State of Rhode Island will use the same tax rate schedule for 2019 that it used for 2018 -- Schedule G. The Department of Labor and Training DLT today announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022.

DLT also announced that the 2021 Temporary Disability Insurance TDI taxable wage base will be 74000 and that the employee contribution rate. The UI taxable wage base will be 24600 for most employers and 26100 for employers at the highest rate. For all unemployment claimants that received benefits in 2021 the 1099-G form is now available to download on the DLT website.

30 2021 from Sept. Under federal legislation enacted on March 11 2021 if a taxpayer received unemployment benefits in 2020 and the taxpayers federal adjusted gross income AGI was less than 150000 for. Unemployment claimants can earn more and keep more of your benefits while working part-time.

The taxable wage base for Rhode Islands state unemployment insurance tax UI will be 24600 in 2021 for most employers compared with 24000 in 2020 an increase of 600 or approximately 25. Mar 29 2021 0655 PM EDT. Up to 25 cash back In recent years the employment security tax component generally has been around 275 and the job development tax component between roughly 2 and 5.

For those employers at the highest tax rate the UI taxable wage base will be set. Rhode Island taxes unemployment taxes. UI tax rates are calculated using a statutory formula based on the balance of the states employment security fund.

It is hoped that delaying the SUI tax computation date to as late as November 30 2021 will allow the states UI trust fund balance to further recover before determining the rate. 13 TAX RATES 120 to 980 Deducted from Employment Security 099 to 959 Employees Wages Job Development Assessment JDA 021 NEW EMPLOYER RATE 095 not including 021. Besides the state income tax The Ocean State has three additional state payroll taxes administered by the Division of Taxation.

Unemployment insurance payments are taxable income. Rhode Island Governor Daniel J. Because of the high number of unemployment claimants in 2021 resulting from.

You can also earn up to 50 of your weekly benefit.

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

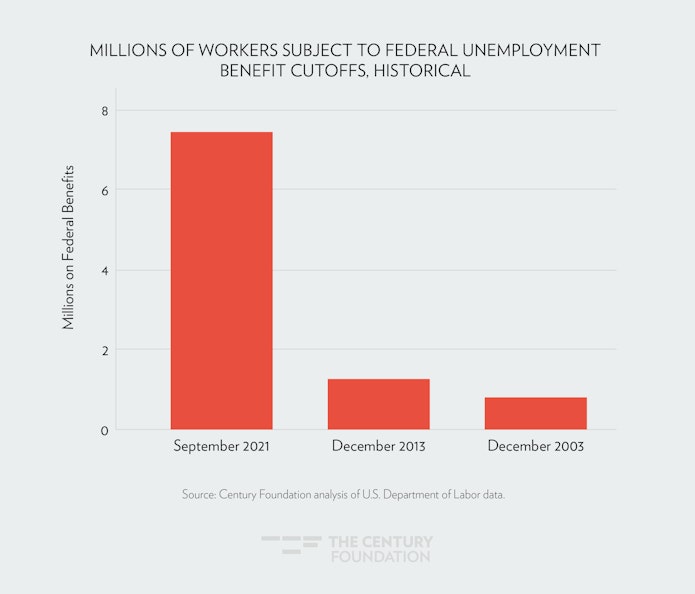

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

How Unemployment Benefits Are Calculated By State Bench Accounting

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

Unemployment Benefits Comparison By State Fileunemployment Org

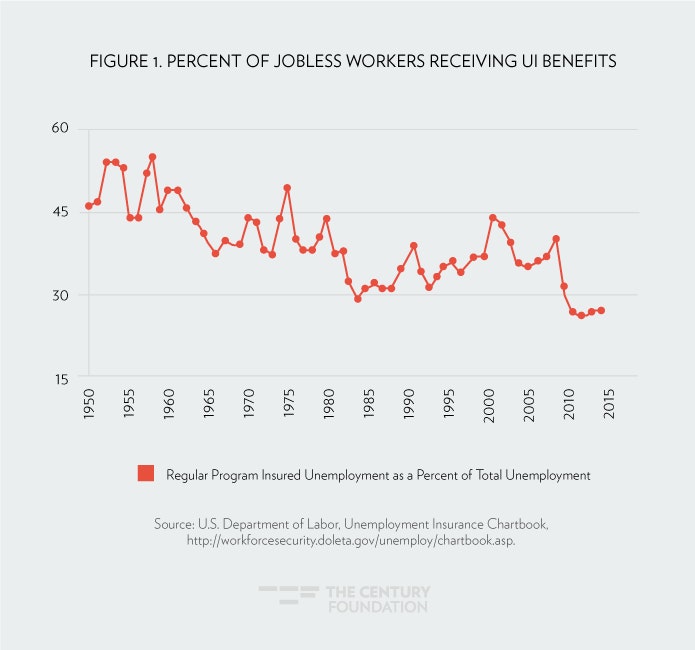

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

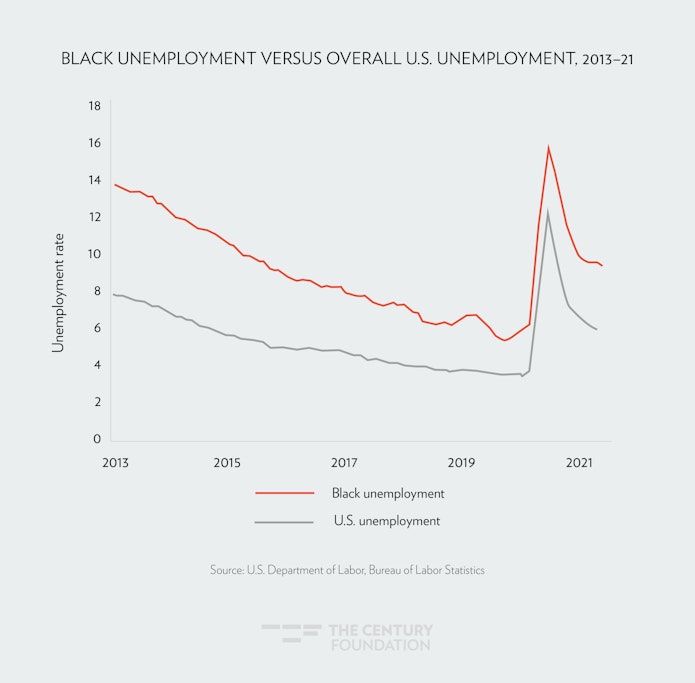

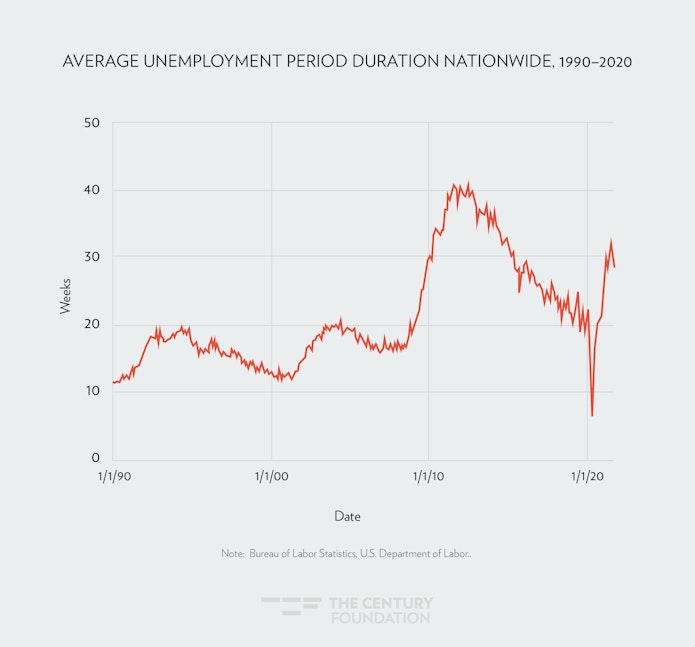

The Unemployment Impacts Of Covid 19 Lessons From The Great Recession

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

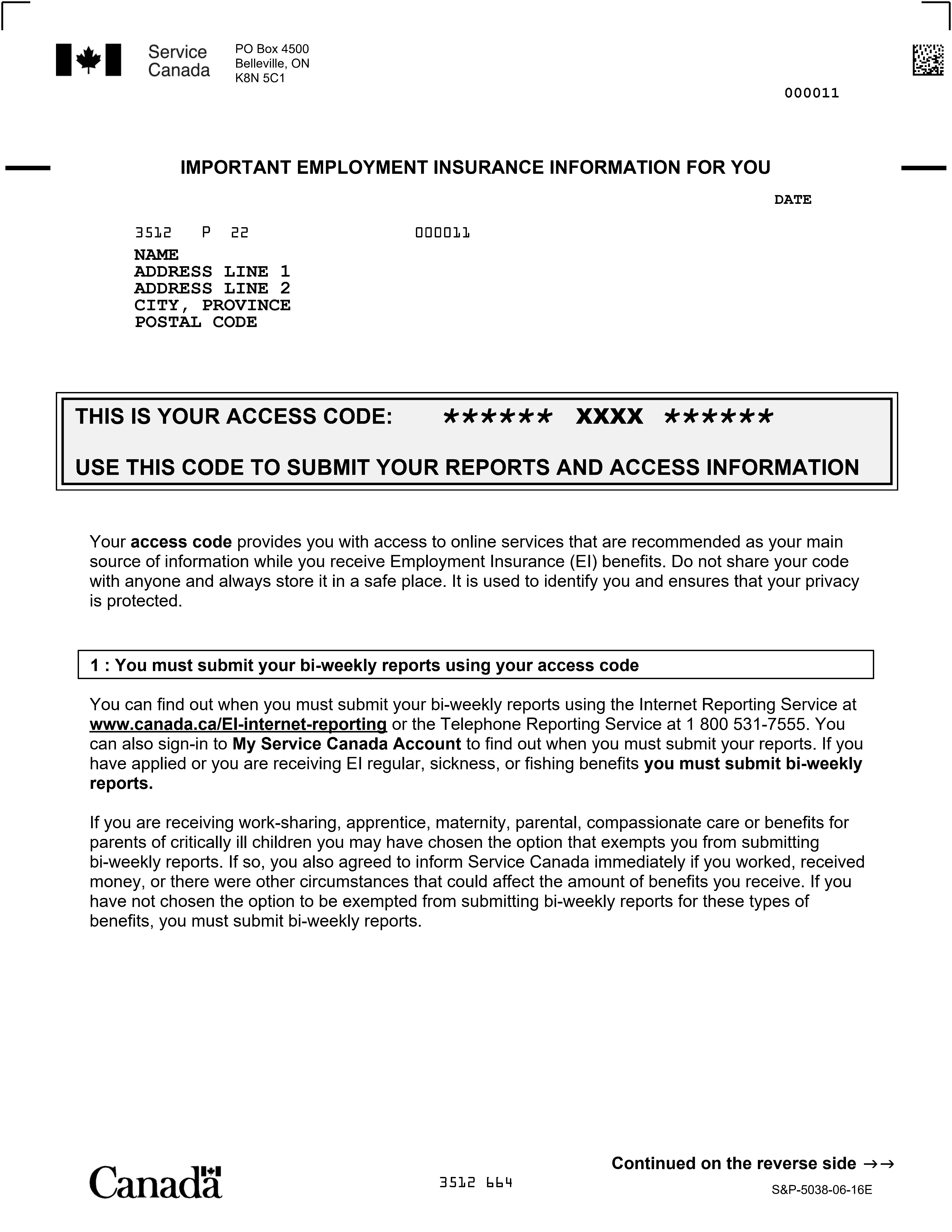

Employment Insurance Ei Benefit Statement Canada Ca

No 10 200 Unemployment Tax Break In 13 States Could Mean Higher Taxes

Delivering Unemployment Assistance In Times Of Crisis Scalable Cloud Solutions Can Keep Essential Government Programs Running And Supporting Those In Need

600 Unemployment What Happens When A Stimulus Lifeline Ends The New York Times

Andy Boardman Here S How A Rhode Island Employment Bonus Proposal Would Work And How It Can Be Improved

600 Unemployment What Happens When A Stimulus Lifeline Ends The New York Times

Is The Extra 600 Unemployment Check Weekly Your Money Questions Answered

4 Reasons Americans May Be Denied Social Security Disability Benefits Social Security Disability Benefits Social Security Disability Disability Benefit

Unemployment Insurance Extended Benefits Will Lapse Too Soon Without Policy Changes

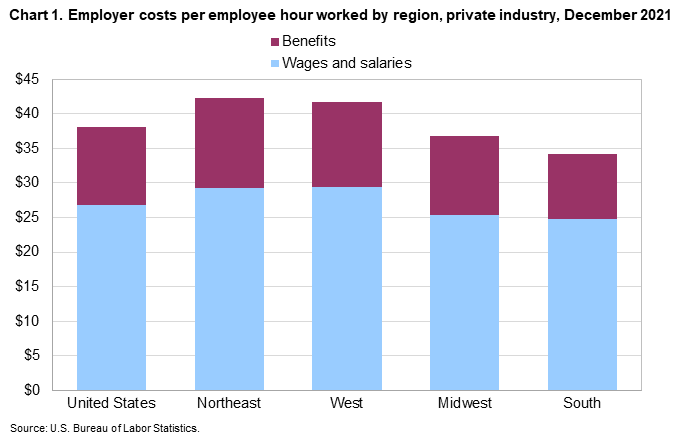

Employer Costs For Employee Compensation For The Regions December 2021 Southwest Information Office U S Bureau Of Labor Statistics

Unemployment Insurance Improvement Act Nails Key Floorboard Under State Programs